Current Trends in Mortgage Rates

Mortgage rates have climbed to their highest levels since July 2024, creating significant headwinds for homebuyers and homeowners seeking to refinance. The average 30-year fixed mortgage rate now stands above 7.5%, marking a substantial increase from earlier months when rates hovered around 6.8%.

This rise has been driven by stronger-than-expected economic data, persistent inflation concerns, and the Federal Reserve’s cautious approach to rate adjustments. As the cost of borrowing continues to rise, prospective buyers are increasingly sidelined, leading to a notable drop in mortgage applications.

Mortgage Application Trends and Declines

Declining Mortgage Applications

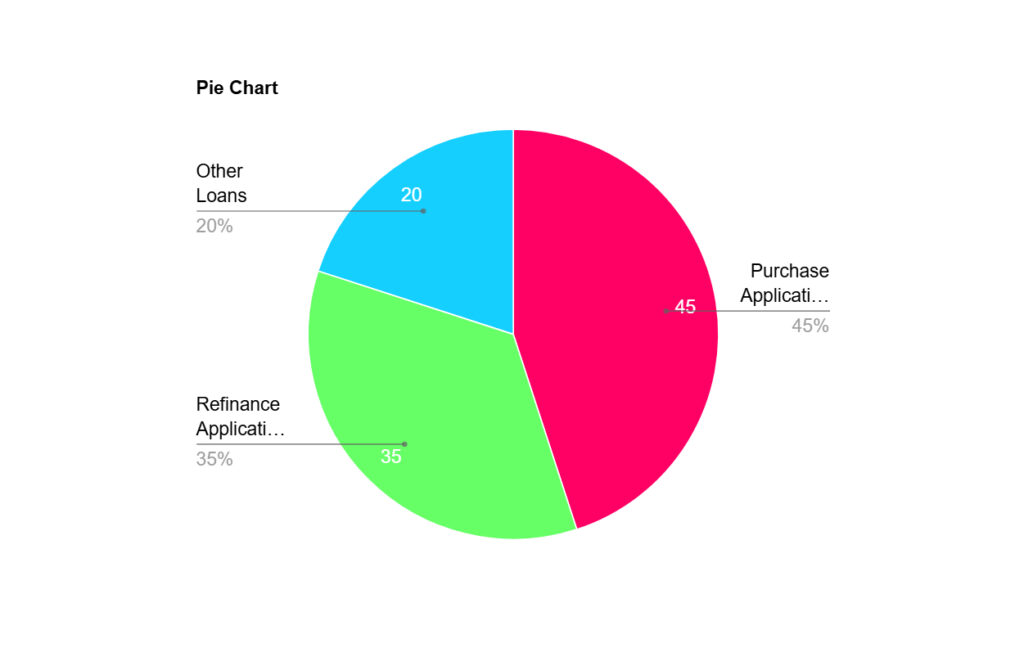

Data released by the Mortgage Bankers Association (MBA) highlights a 9% week-over-week decline in total mortgage applications. Both purchase and refinance applications have taken a hit as affordability challenges mount.

Key Statistics:

- Purchase applications fell by 7%, reflecting hesitation among buyers.

- Refinance applications dropped by 12%, indicating reduced incentives for homeowners to refinance existing loans.

- Year-over-year comparisons show a staggering 30% decline in overall application volume.

Impact on First-Time Buyers

First-time buyers, who often rely heavily on mortgage financing, are among the hardest hit. With rates at multi-year highs, many potential buyers face difficulty qualifying for loans, particularly in competitive housing markets with rising home prices.

Factors Driving Rising Mortgage Rates

Federal Reserve Policies

The Federal Reserve’s ongoing battle against inflation has led to higher benchmark interest rates. Although no immediate rate hikes are planned, the Fed maintains a hawkish stance, leaving open the possibility of further tightening.

Economic Indicators

Stronger-than-expected job growth and consumer spending have fueled concerns about inflationary pressures, leading to higher yields in the bond market. Mortgage rates, which often track 10-year Treasury yields, have risen in response.

Global Economic Uncertainty

Geopolitical tensions and global economic instability have added to market volatility, impacting mortgage-backed securities and pushing rates higher.

Outlook for Mortgage Rates in 2024 and Beyond

Market Projections

While some analysts predict slight easing by mid-2024, others caution that rates could remain elevated throughout the year if inflation proves persistent.

Strategies for Homebuyers and Refinancers

- Locking in Rates Early: Buyers are encouraged to lock in rates when favorable terms arise.

- Exploring Adjustable-Rate Mortgages (ARMs): ARMs may offer lower initial rates, providing flexibility for short-term homeowners.

- Negotiating Loan Terms: Working closely with lenders to negotiate terms and fees can improve affordability.

Impact on Housing Market Dynamics

Reduced Home Affordability

Higher mortgage rates have effectively reduced buyers’ purchasing power, leading to softer demand in certain markets. As affordability declines, price growth may slow, creating opportunities for price corrections in overheated markets.

Shifts in Seller Behavior

Homeowners with locked-in low rates are increasingly reluctant to sell, leading to reduced housing inventory and further tightening supply.

Rental Market Growth

As more potential buyers remain renters, demand for rental properties continues to grow, potentially leading to higher rents in key urban markets.

Visual Representation of Mortgage Trends

Expert Recommendations for Navigating High Rates

1. Assess Financial Readiness

Buyers should evaluate budgets, credit scores, and debt-to-income ratios to improve loan eligibility and secure favorable rates.

2. Compare Lenders

Exploring multiple lenders can help uncover better interest rates and loan terms, potentially saving thousands over the loan’s lifetime.

3. Consider Down Payment Assistance Programs

State and federal programs offer financial assistance for qualifying buyers, reducing the upfront burden of homeownership.

Conclusion

The recent surge in mortgage rates has created challenges for buyers and refinancers alike, leading to a sharp decline in application demand. As economic conditions evolve, staying informed and proactive can help borrowers navigate this high-rate environment.

Whether you’re a first-time buyer or a homeowner looking to refinance, understanding market trends and exploring creative financing options can make homeownership more attainable even in uncertain times.